Your very first budget

Jun 16 | 2017

I’ve always wanted to be independent from my parents ever since high school. I admit I got a late start, but I’m slowly transitioning from college to an apartment where I take care of myself. It can be scary though — what does “utilities” even entail — especially for someone like me who needs to plan everything out with numerous lists and endless research.

The pregame plan

Before you start, you should probably get some things in line so they don’t come back to bite you in the butt later. Set aside some days to browse flea markets, garage sales or apps that sell cheap appliances, starting furniture and maybe even kitchen supplies. I scoured bins of unwanted objects my fellow students didn’t want after the year ended — aim for the rich international students. I scored a microwave, a mini fridge, full-length mirrors and some other useful stuff.

If you’re still being taken care of by your parents, see if they’ll keep you on their cell phone plan and health insurance if it’s too much for you to take on for now. I know my parents wanted me to stay on because they got a discount for a family plan. When you’re finally ready, you can take care of these things for yourself.

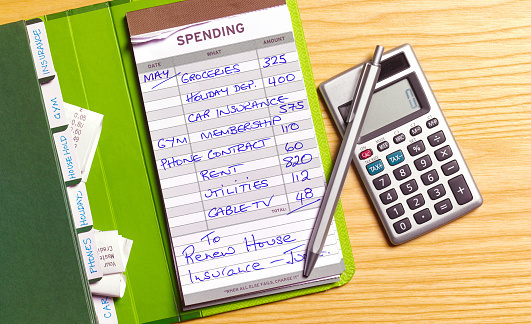

Set your budget

Always make a budget with the amount you are getting paid at the moment or an estimate that resides on the lower side. It’s so easy to overestimate and get ahead of yourself which will leave you out to dry later. Calculate what you’ll make per week, per month and per year so you can make long and short-term budgets.

Rent and utilities

This is the most important aspect of your budget and something you should always set first. Between my boyfriend and I, we could afford to pay rent up to $2,000 a month in NYC but settled for an $1,800 apartment. Try to find a roommate — or a couple — if you can as paying rent by yourself can be bothersome. Also rent will of course be cheaper if you choose to live elsewhere.

Utilities include electric, gas, water, Internet, and whatever else you need to make your apartment run. Some apartments have rent that covers the utilities so make sure you check up on that. I would set aside about $200 or more for these utilities but if you are moving into a house or a bigger home, it will go up.

Transportation

Since I live in the city, we get around by subway and Uber. It’d be super impractical to have a car since we’d have to pay for parking and gas. However, if you do decide to purchase a car or keep one you already have, set aside a budget for that. Be sure to include gas, car insurance, parking fees and maintenance.

However, if you take public transportation, consider an unlimited pass. An unlimited monthly Metrocard costs about $121 plus extra money for lazy Uber’s will be about $150 per month. Decide how you should get around based on your surroundings.

Groceries, Toiletries and Miscellaneous

Since my boyfriend and I eat a ton — we’re both super athletic — our grocery bill will stack up. We set the grocery budget to about $500 per month but a money-conscious normal-eating person could get by at around $300. Note that eating out is NOT included in this budget.

Toiletries range anywhere from tampons to toothpaste. Set aside $100 or so to get your monthly needs. Miscellaneous items include entertainment, play, date nights, Grubhub, or anything else you might want to indulge yourself in. We set aside another $100 for this as we don’t really have any room for fluff.

Savings

You should have two categories of savings — emergencies and long-term. Emergencies can be anything from car crashes to rodent drop-in’s. Long-term is for money that you’re saving towards a long-term goal or expense. If you’re slowly building up to an apartment to a house or starting early on your 401K, this fund covers that.

My boyfriend and I usually use the rest of the money from what we made that month towards the savings which adds up to about $600. If you think what you’re saving isn’t enough, redo your budget with cheaper amenities or skim from another category — looking at you, “miscellaneous.”

I understand that my boyfriend and I have very well-off jobs for young adults just coming out of their teens so our budget might be bigger than most. Feel free to adjust this budget however you would like, but be sure to include all the elements. If you aren’t quite ready to move out yet, that’s fine too! This guide will still be here for you in a few years.