Celebrating Pioneering Women in Finance

Mar 10 | 2025

Photo Credit: Olia Danilevich

Let’s be real: money plays a huge role in all our lives. We work hard for it, try to save it, sometimes splurge on things that make us happy, and frequently stress about having enough of it.

But beyond just paying the bills, financial knowledge is power—especially for women. Historically, the finance world has been a boys’ club, but women have always been capable of making just as much impact, if not more.

Women have been making serious power moves in finance for centuries, often without getting the credit they deserve. That’s why we’re celebrating the pioneers who shattered ceilings, took over boardrooms, and changed the game.

Some of these names might be familiar, others may be new, but all have left an undeniable mark on the financial world.

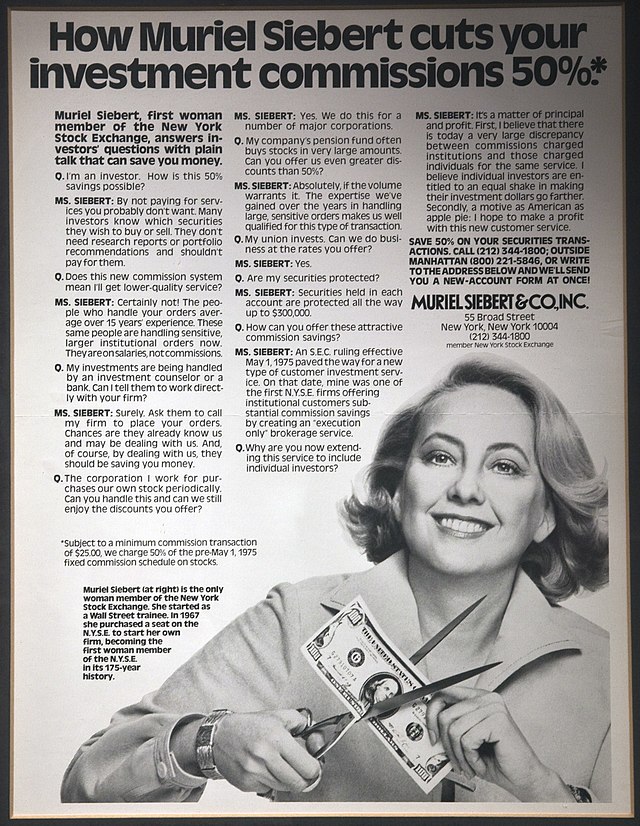

Muriel Siebert: The Woman Who Crashed Wall Street’s Boys’ Club

Walking into a room where no one looks like you is not easy. That was the case for Muriel “Mickie” Siebert in 1967 when she became the first woman to own a seat on the New York Stock Exchange (NYSE). A woman. On the NYSE.

Back then, that was unfathomable. Muriel had to fight tooth and nail just to get her foot in the door, facing rejection from multiple firms before finally breaking through. But once Siebert got in, she made sure to help other women do the same.

Siebert’s legacy is one of resilience, breaking barriers, and proving that finance isn’t just for the boys.

Maggie L. Walker: The First Black Woman to Own a Bank

Let’s go back even further to 1903 when Maggie Lena Walker did something unthinkable at the time. Walker became the first African-American woman to charter and run a St. Luke Penny Savings Bank bank. And she didn’t stop there.

Walker was all about empowering Black Americans with financial independence, advocating for economic self-sufficiency during an era when opportunities for Black people were extremely limited.

She was the original financial influencer, teaching people how to save, invest, and build generational wealth before those were even common terms.

Hetty Green: The Billionaire Before Billionaires Were a Thing

Now, if you think women weren’t making big financial moves in the 1800s, let me introduce you to Hetty Green—also known as the “Witch of Wall Street.” No, not because she brewed potions (though, with her money skills, she might as well have).

Hetty was a self-made financial powerhouse who made her fortune through real estate, stocks, and bonds—at a time when women weren’t even supposed to handle their own bank accounts.

She was notorious for being incredibly frugal (we’re talking wearing the same black dress every day kind of frugal). Still, she had an investing strategy that built her an empire worth billions in today’s dollars. Love her or not, you have to respect her hustle.

Jane Fraser: The First Woman CEO of a Wall Street Bank

Fast forward to 2021, and we have Jane Fraser, making history as the first woman to lead a major Wall Street bank—Citigroup. When she stepped into the role, many wondered how she’d handle it. And, of course, she crushed it.

Her leadership style is a mix of financial genius and straight-up common sense. She’s known for making big moves, including restructuring Citi to make it more efficient and tackling global economic challenges head-on.

And seeing a woman in one of the highest positions in global finance feels right.

Pam Kaur: Making Big Banking Actually Diverse

Finance still has a diversity problem. But women like Pam Kaur are changing that. She made history as HSBC’s first female Chief Financial Officer, breaking a 160-year-old streak of… men.

Her expertise is risk management, compliance, and ensuring the bank doesn’t go up in flames financially (just the person you want in charge). More importantly, she advocates for gender equality.

More Women, More Power, More Money

Here’s the bottom line. Women have always been in finance. We’ve built banks, managed billions, and led financial revolutions. The problem is we haven’t always been recognized for it.

But times are changing.

Women are now at the forefront of financial innovation, investment strategies, and global economic leadership. And as more of us take our seats at the table, we’re not just asking for a slice of the pie—we’re baking the whole damn thing.

And if you’re managing your own finances, climbing the corporate ladder, or dreaming of starting your investment empire, remember this: there’s no ceiling too high, no industry too male-dominated, and no barrier we can’t break.