New Year, New Budget

Feb 01 | 2024

Saving money starts with a budget.

Alexander Grey via Unsplash

I’ve been thinking a lot about goal setting in the New Year…and not in the cliche resolution way. Not in the way that I get overzealous and aim to save $10,000 in one year, change my entire life around, and find the apartment of my dreams. Not in the way that sets me up for failure.

Because we know the excitement of a fresh start: you want to throw your entire being into transforming your life, only to burn out 10 days in. It’s tough to set achievable goals when you have high expectations for your life because you feel like you’re not doing enough.

So, when I say I’m setting goals, it’s on a month-by-month basis. At the end of each month, I sit down and write out small, achievable tasks I want to accomplish. For January, that’s working out a few times a week, journaling more, going to the dermatologist, and putting my budget in order.

I know that I plan to move in the summer, so I want to be prepared for moving costs, refreshed furniture, etc. And I don’t want to push this off until I’m forced to pile on top of credit card debt, further burdening my stress.

In my efforts to get my new budget ready, I had to do some research. Being a 25 year old woman doesn’t mean I’m automatically familiar with the ins-and-outs of Finance 101. However, I think it’s important for the reader to note that 99% of people my age have no clue about what’s going on in their bank accounts 100% of the time.

@hermoneymastery How to budget 🤍 Here are the things that need to be included in your budget: -fixed expenses (all your bills including debt payments) -variable expenses (grocery, gas, date night, fun money, etc. that happen monthly) -sinking funds (specific things you want to save for in the future… ex. Car repairs, vacation, new house, etc… longer term than variable expenses) #budgetingtiktok#howtobudgetforbeginners#howtobudget#moneytips♬ Chill Vibes – Tollan Kim

If you don’t even know where to begin, that’s completely fine. I’ve picked a few budgeting methods that will help you recognize your spending habits so you can focus on allocating some of your monthly income that will help you save over time. While the notion of paying for food, utilities, rent, and more may be overwhelming, setting up your budget can help it become doable.

Here are some of my favorite budgeting tips:

50/30/20 Rule

50/30/20 Rule

The 50/30/20 rule is relatively simple: allot 50% of your monthly income towards needs, 30% towards wants, and 20% towards savings and debt repayment.

Your needs are those items you absolutely have to spend money on per month: housing, groceries, utilities, transportation, minimum credit card payments. Your wants are new clothes or shoes, an event with your friends, the more expensive organic groceries.

If you’re in savings mode, you may want to cut back on a lot of your “wants.” You may not need to splurge on fresh, organic blueberries for those smoothies when frozen ones are cheaper. Plus, that new pair of shoes can wait.

So, make a choice: decide which streaming services and subscriptions belong in your “wants” or “needs” category. A good way to tell is seeing how often you use these services, and ditch the subscriptions you use the least and bank those bucks each month.

Sincerely Media via Unsplash

Always Have An Emergency Savings Fund

Always Have An Emergency Savings Fund

That 20% towards debt repayment and/or savings or can save you in dire situations. When I was living at home rent free, I started an emergency savings account to use at my discretion. In tight times, it helps to have a nest egg to fall back on.

When I get paid, I always replenish any amount I took from my savings and incorporate that into my budget.

Towfiqu barbhuiya via Unsplash

Make A Plan To Pay Off Your Credit Card Bill

Make A Plan To Pay Off Your Credit Card Bill

Credit card bills and loan repayments — and subsequent interest fees — are considered “toxic debt”. This is debt that can get out of control and quickly become unmanageable. Debt collectors and credit card companies can devastate your credit with toxic debt, which is why it’s important to keep your credit card debt under control.

That will entail paying above the monthly minimum charge on your card and steadily bringing down your balance to achieve that goal. But once you’re out of debt, your credit (and wallet) will thank you. Be sure that 20% towards savings and debt payment really goes towards your bill.

rupixen.com via Unsplash

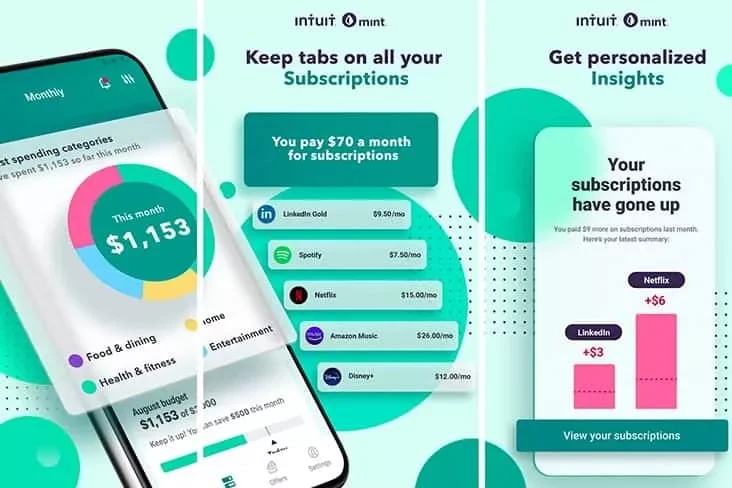

Download A Budgeting App

Download A Budgeting App

Building a smart budget that you can stick to while holding yourself accountable. Everybody’s familiar with the dreaded holiday credit card debt, so we also compiled a list of best personal finance apps for 2024 that will help get your budget in check.

Mint App

Check Your Bank Account!

Check Your Bank Account!

The ultimate anxiety of checking your bank account after a long weekend with your friends is real. But suck it up, it helps you understand your spending habits. If you check your bank account regularly, you’re aware of where your money is going at all times. Also, you can flag unrecognized expenses and adjust your spending before it’s too late.

Although it may feel like overkill, try actually jotting down every single purchase you make in a month for three months. You’ll be a more conscientious consumer and understand your wants versus needs.

Eduardo Soares via Unsplash