No Santa to bail you out this year, it's all you

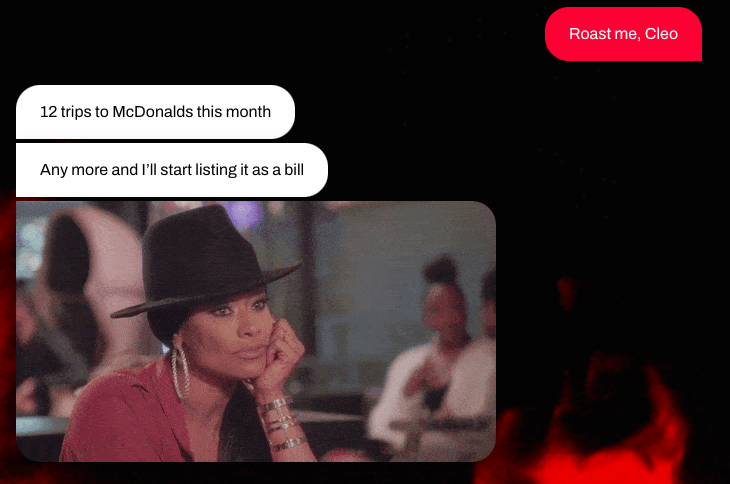

via Cleo

Ah yes, ’tis finally the giving season!

As someone whose love-language is gift giving, I relish most opportunities to spoil my friends with sweet tokens of appreciation. I am the queen of spontaneous gifts. When I’m puttering around the city, doing my silly little tasks, I always perk up when I find some small trinket that I can give my friends.

Nothing says “I love you” more than saying, “hey, this reminded me of you.” And then handing them a nod to a past conversation, or a memory we share. So, sorry to my friends for cluttering your houses with sentimental junk, but I’m even more apologetic for my fatal flaw: when it comes to the holidays … I always draw a blank!

To me, organic gifting is much more genuine than holiday gifting. Yet, if I were to use that as an excuse for turning up empty-handed to every single holiday party this season. I fear I’d start the new year off with fewer friends. And, as someone who loves to receive gifts just as much, I don’t want to chance burning bridges that might hold presents on the other side.

So, when the holiday season arrives, I spend far too much of my precious time strategizing my gifts for my friends.

Often, when I draw a blank, I end up splurging on expensive gifts — a luxury candle, a decadent face oil, a classy bottle of perfume. Sure, these opulent gifts are a cop out, but they’re guaranteed successes. Upon opening a package containing their favorite, overpriced indulgence who wouldn’t smile?

Due to my holiday default, I’m forced to do some serious budget planning to accommodate my lavish spending. Or, more often, I go spectacularly over-budget.

However, this year, I must make a change. After my summer of post-vax hedonism that granted justification to spend more money than I’d ever dare, my holiday budget’s looking pretty lean.

After sitting myself down and giving myself a strict talking to about prioritizing my savings, I’ve come up with some tips on how to save money around the holidays:

Review your budget

The amount of money we think we spend and the money we actually spend are two very different numbers. Grab a drink, pull out your bank statements, it’s time to get to the bottom of your spending.

Take a look at two or three months and categorize your purchases. Which ones were intentional? Which ones were emotional? And how many times did you go to the coffee shop just to feel something and leave with a $10 latte and pastry? Once the truth is laid out in front of you, it’s easy to see where you’re bleeding money.

For me, it’s coffee shops and boutique clothing stores I discover during jaunts around trendy neighborhoods. Whatever your vices are, do your best to become aware of them.

Budgeting apps like Cleo have helped me curb my impulse spending a ton! Cleo talks to me like a friend would — a friend who is not afraid to tell me no and call me out on my overspending. We all need a friend like Cleo, so download the app and watch your budget change overnight.

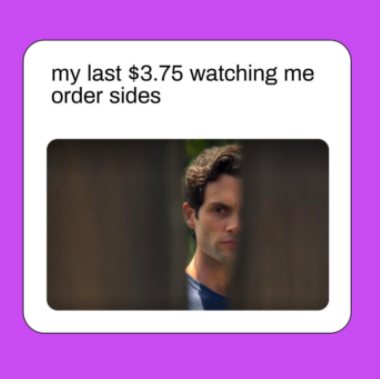

via Cleo App

via Cleo App

Cut out what you don’t need

It’s all well and good to glance at your spending, but the next step is brutal: get honest with yourself about the purchases you could have gone without. But this isn’t about deprivation, it’s prioritization. What can you relinquish now to ensure you have a great holiday season later?

Cringing at past impulse buys I’ve made, I vowed to avoid my typical temptations, since I couldn’t resist them. I know I’m easily lured into charming little storefronts downtown. So I took new routes home, avoiding the streets where all the cool clothes lie, waiting for me to cave.

I’m sure, in good time, I’ll be back. But that’s a problem for 2022-me. Until then, we just have to hold out for less than two months, get the gifts our friends deserve, and then it’s back to regularly scheduled planning.

Make a spending plan

Saving without a plan usually leads to spending. As you narrow down what you can afford, figure out what you want to buy. I like to split it into categories: larger expenses vs. affordable picks.

Here’s the fun part: shopping around. Sometimes I only have a general idea of what I want to buy, and sometimes I have specifics in mind. Either way, I love to shop around for a deal.

When it comes to saving money, research is paramount. Various vendors might have different prices, promotional codes, or sales. A quick Google search can often save you 10% or more, so don’t take the first price you see as gospel.

via Cleo App

via Cleo App

After finding the best price, I can budget for what I’m going to buy and when. Which takes me to ….

Take advantage of sales … strategically

The holiday season brings with it the promise of big, blowout sales. But, if you’re not careful, you can end up spending more money during a sale — which is precisely the stores’ intention.

Don’t fall victim to the allure of those big, red “SALE” stickers. Instead, plot out how to take advantage of a number of sales for different products. Adding those sale prices to your spending plan will keep you focused and on track, instead of buying frivolous items no one will ever use just because the prices are slashed.

Saving money over the holidays doesn’t mean you have to make a Scrooge of yourself. You can still gift and gift well, just more intelligently. Spending with intention is key to savings, while investing thoughtfully into your relationships.

Apps like Cleo can help you keep your finances on track without feeling overwhelming. With one download, you could be on your way to mega-savings.

Happy gifting!