Easy Ways to Stick to a Budget

Sep 14 | 2021

Cleo budgeting app

Sticking to a budget is super important for everyone, no matter how much you’re making or how much money you’re trying to save… But it’s often incredibly tricky.

Here are five easy ways to stick to a budget.

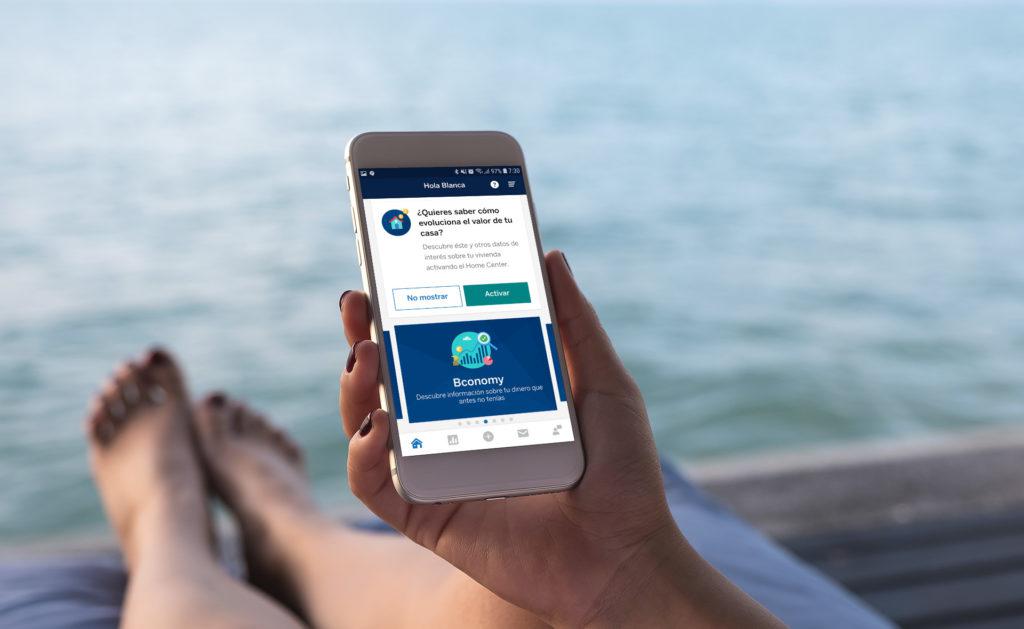

1. Use a Budgeting App

One of the easiest ways to stick to a budget is by using an app specifically designed to help you keep track of your finances and hit your saving goals. One such app is Cleo, an app that, per its own website, decisively “doesn’t suck.” Cleo connects to your bank and tracks your spending — and it uses a special AI integration that will literally call you out if you break your pledges.

appBBVA

appBBVA

Cleo will help you budget, save, build credit, and much more, and it comes with special quirks that will make saving a bit more fun — including a “swear jar” that helps you control your worst spending habits. A budgeting app can act like an old friend looking over your shoulder and giving you a little extra support as you try to stick to your financial goals, and Cleo is definitely the friendliest of budgeting apps around.

2. Be Realistic

You’re not going to want to stick to your budget if you set it way too low — then every time you look at your budget you’ll find yourself disappointed and sad, and it’ll keep spiraling. When you set your budget, be realistic and make sure you also have categories for emergency expenses or splurges. It’s not like you’re never going to splurge on your item of choice (be it an expensive meal out or an impulse-bought outfit), so put that into your budget as well and figure out where else you can save or skimp in order to make room for those inevitable stretches.

3. Review Your Budget Regularly and Build Your Habits Over Time

No matter how you hack your budget, be sure that you make checking and reviewing it into a routine. Be sure you review your spending at least every two weeks, if not once a week, and give yourself time to grow. Like any other skill, budgeting takes practice, and you’ll get better at it the more you do. You might even try to set a timer for once a week and give yourself fifteen minutes to go over your budget at that time.

It’s important to start slow and build your budgeting muscle over time as well. If you’re just getting started or have a history of failing to properly budget, start with one or two categories and go from there. Or challenge yourself to save on one area each week, and then add more goals as time passes.

4. Determine What You Want to Do With Savings

It’s important to feel like all your budgeting work has a purpose. Finding your “why” and figuring out what you’re budgeting and saving for can really motivate you to do better, and this makes giving up little expenses a lot easier. Figure out what exactly you want to accomplish with your budget, and also make sure your goals are achievable and possible.

Of course you’ll need savings for an emergency fund, and maybe you need to save to pay off loans and retirement; be sure you have specific goals for these categories, and also it’s never a bad idea to pick a few fun things to save for.

5. Automate Your Savings

Saving money is hard, when all is said and done, so it might be easier for you to just automate your savings so all that cash doesn’t suddenly appear in your bank account, giving you the illusion that you can buy whatever you want (until you’re broke before the next payday). You might want to enroll in a 401(k) plan or schedule automatic transfers to a saving account. Just be sure that you’re tracking how much you’re saving, and once you’ve saved enough you can consider investing.

Of course, Cleo is probably the easiest way to implement all of these tips, since the app helps you do all this and more (with a fun and friendly twist), and it’s free! (Or you can get the plus version for $5.99 a month, which gives you features like Cleo Cover, a form of overdraft protection, and Daily Cash, a cashback rewards program).

Happy budgeting!

app

app