What is Robinhood?

The Robinhood app debuted in 2013 as a first-of-its-kind revolutionizing free investment platform. Much like the 700-year-old story of the hero to the people, Robin Hood, FinTech entrepreneurs Vladimir Tenev and Baiju Bhatt created the platform in order to make stock trading easily accessible to the general public and not just the wealthy.

What do I need to open a Robinhood account?

Essentially, you don’t need anything but your basic info and email to get your account started. Since Robinhood doesn’t require a minimum deposit, you can connect your banking accounts after setup. Your Robinhood account can be accessed either from the web or through their mobile app.

Once you link your financial institution to transfer funds into the account, you can start buying and selling stock. Robinhood features instant deposits, which makes up to $1000 of your pending bank transfer available immediately for trades. This can be crucial if you wish to buy on stock right away for max gains, as it can take up to five business days for the transfer to go through.

The most enticing aspect of joining Robinhood may just be the randomized free stock they give to each user at sign up. Although there is a 98% chance that stock will range anywhere from $2.50-10 in value, there’s a 2% chance you might receive a stock valued at $200 or more!

Robinhood features

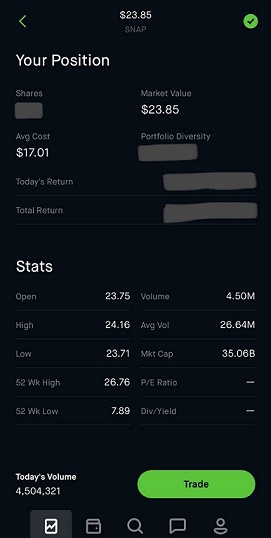

- Robinhood offers fractional share purchases. This allows you to buy a portion, or fraction, of a stock share. Say you want to invest in Tesla stock but don’t want to put around $400 into buying one share of it. With fractional shares, you can invest as little as $1 into stocks like Tesla.

- The refer a friend program offers you another randomized free stock for each successful referral.

- With Robinhood’s cash management program, uninvested cash deposits are managed through Robinhood’s network of program banks, where it earns a variable interest (currently .30%) and is protected under FDIC insurance regulations. You also receive a debit card for use of the funds and can make purchases online through Apple Pay, Google Pay, and Samsung Pay. All of this is offered to Robinhood users free of charges or fees.

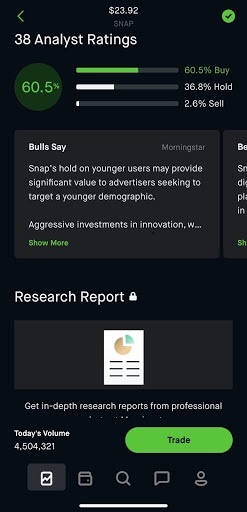

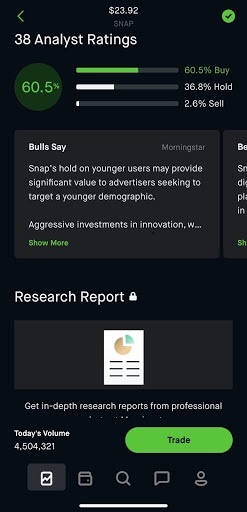

- For $5 a month, users can upgrade to Robinhood Gold. With Gold membership, you get higher thresholds for instant deposits, substantially superior market research through Morningstar and NASDAQ, and access to margin trading to buy stocks on borrowed money.

The Downfalls

- The user is in complete control over which funds to buy and sell. There is no financial advisor in charge of your investments. With complete control, the user has to either take time to do their own research or take the risk of possibly losing big without having expert advice.

- Robinhood limits you to only one account option, a brokerage account. Without the option of a tax-deferred retirement account as the investment vessel, users have no choice but to pay taxes on the account right away.

Who is Robinhood Best Suited for?

Robinhood offers cryptocurrency trades from many of the biggest companies in the business. Being one of the few brokerage apps that allow this, Robinhood is great for people looking to get into crypto investing.

Generally speaking, Robinhood is best for new-to-investing users who want to try an innovative way to dip into the world of investing with a little bit of cash. However, I wouldn’t recommend this app for anyone looking for anything long-term.

While Robinhood gained much of its craze because of being the first commission-free trading app, many more brokers have also gone to commission-free trades. Ameritrade and Fidelity are two brokerages that offer commission-free trades but with the full service and options of a mainstream brokerage.

- Robinhood offers fractional share purchases. This allows you to buy a portion, or fraction, of a stock share. Say you want to invest in Tesla stock but don't want to put around $400 into buying one share of it. With fractional shares, you can invest as little as $1 into stocks like Tesla.

- The refer a friend program offers you another randomized free stock for each successful referral.

- With Robinhood's cash management program, uninvested cash deposits are managed through Robinhood's network of program banks, where it earns a variable interest (currently .30%) and is protected under FDIC insurance regulations. You also receive a debit card for use of the funds and can make purchases online through Apple Pay, Google Pay, and Samsung Pay. All of this is offered to Robinhood users free of charges or fees.

- For $5 a month, users can upgrade to Robinhood Gold. With Gold membership, you get higher thresholds for instant deposits, substantially superior market research through Morningstar and NASDAQ, and access to margin trading to buy stocks on borrowed money.

The Downfalls

- The user is in complete control over which funds to buy and sell. There is no financial advisor in charge of your investments. With complete control, the user has to either take time to do their own research or take the risk of possibly losing big without having expert advice.

- Robinhood limits you to only one account option, a brokerage account. Without the option of a tax-deferred retirement account as the investment vessel, users have no choice but to pay taxes on the account right away.

Who is Robinhood Best Suited for?

Robinhood offers cryptocurrency trades from many of the biggest companies in the business. Being one of the few brokerage apps that allow this, Robinhood is great for people looking to get into crypto investing.

Generally speaking, Robinhood is best for new-to-investing users who want to try an innovative way to dip into the world of investing with a little bit of cash. However, I wouldn't recommend this app for anyone looking for anything long-term.

While Robinhood gained much of its craze because of being the first commission-free trading app, many more brokers have also gone to commission-free trades. Ameritrade and Fidelity are two brokerages that offer commission-free trades but with the full service and options of a mainstream brokerage.