Urban Investor’s Dictionary: S&P 500

May 11 | 2017

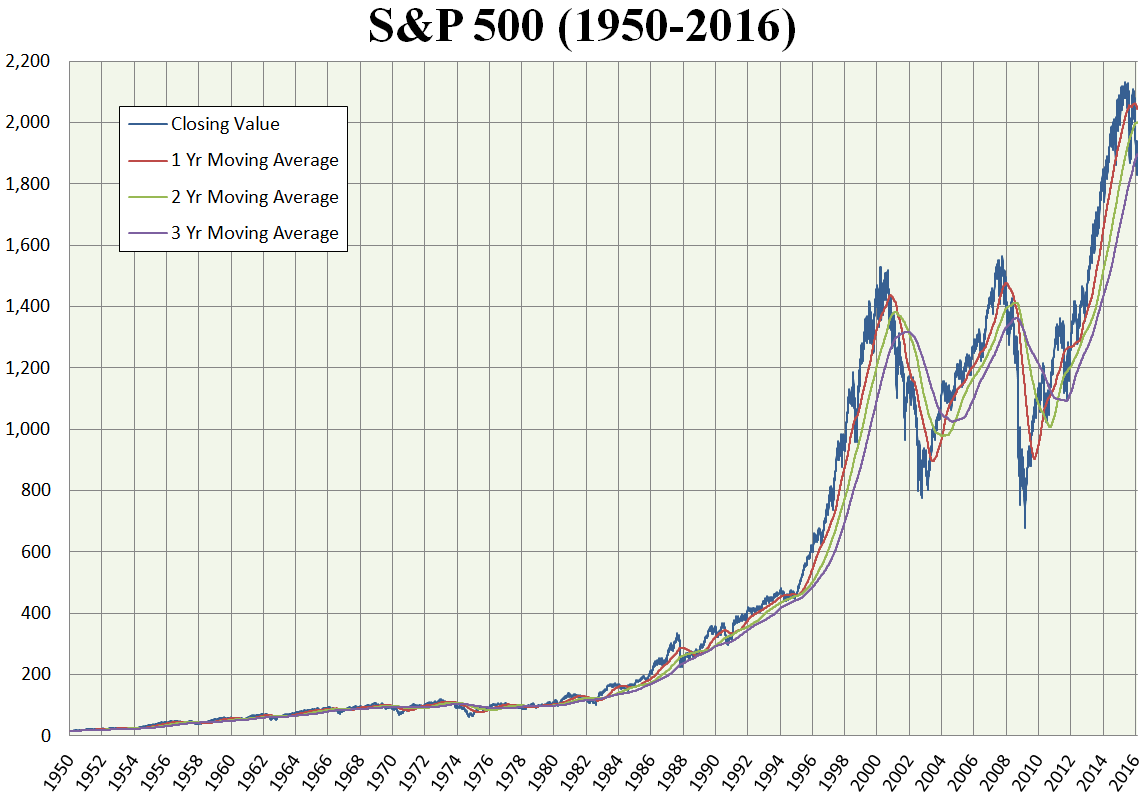

A benchmark of the U.S. economy, the S&P 500 Index is a unique stock index based on 500 large companies that have common stock listed on the New York Stock Exchange, or the NASDAQ.

The S&P 500, Dow Jones Industrial Average, and NASDAQ are the big three of American Stock Market indices. What separates the S&P from the pack however is its wide breadth of companies listed, both American and non-American based. It unseated the Dow as the preferred index for U.S. stocks. With 500 largest companies on its index, and its method of weighing these companies, the S&P 500 Index is accepted as the most accurate measure of the pulse of the American economic ecosystem.

The S&P follows a methodology that is based on a market and a company’s weighting is based on size, unlike the Dow, which is price weighted and based on the price of the stock, thus giving more expensive stocks a higher weight. A team of analysts, economists, and fiduciary wizards use various factors to determine which 500 stocks go into the index. It is this large and highly analyzed grouping of stocks that makes for such a precisely accurate read of the overall American economy.

Henry Varnum Poor, in 1941 would merge his Poor’s Publishing Company with Standard Statistics and therein formed Standard & Poor’s. The company would take a focus on the analysis and dissemination of financial data. The S&P would emerge from early incantations such as the “Composite Index” on March 4, 1957. It was the first index to be published daily, and today more than $7.8 trillion is benchmarked to it.

Today the S&P 500 Index falls under the worldwide umbrella of the S&P Global 1200 index family. There are other indices in the family such as those that cover mid-cap (S&P MidCap 400) and small-cap (S&P SmallCap 600)

There are many popular investment tools that follow and attempt to mimic the S&P 500. ETFs and Index funds that follow Standard & Poor’s most notable index are abundant. One of the earliest to follow the S&P 500 is Jack Bogle’s Vanguard Fund, which returns have shown overtime has outperformed other popular managed funds. Index replication is another popular way to bang your buck off the S&P. Index replication refers to an individual investor or a fund invests in all the same stocks that are in an index.